For Aspiring Traders Who Are Done With Guesswork And Ready To Take Control Of Their Financial Future…

The Most Exclusive Opportunity Investment Fund Is Here…

Official Partnership Offering

FxPremiere have partnered with one of the most Solid Fully Licenced MANAGED FUND

Now Offering Fully Managed Investment Plans for GLOBAL Clients Investing MINIMUM $200,000+ High Return Strategy

If you're a high-net-worth individual, private investor, or family office

looking to scale wealth through data-driven, only one name you need to know in 2025: FxPremiere Fund Partners - Dubai, DIFC Licenced.

Contact us to explore onboarding, schedule a private consultation, or connect with an advisor.

Spaces are limited. HNW onboarding is subject to KYC verification.

High Return Strategy

What Is The Investor Benefits

Conduct of Business Rules

1. A carefully selected portfolio of investments structured for risk-adjusted returns, available only to Professional Clients as per DFSA Conduct of Business Rules (COB).

2. The strategy aims to outperform broader market trends, generating potential alpha while adhering to appropriate risk management frameworks.

3. The investment strategy is managed by qualified investment professional currently based in Dubai.

4. Daily subscriptions and NAV calculations, with monthly redemption options. Investors should review liquidity conditions before investing.

5. No management fee performance-based fee structure applies, subject to a soft annual hurdle rate of 10% calculated quarterly.

6. Risk Warning: Investments are subject to market fluctuations, and capital is at risk. Investors should seek independent financial advice before investing.

FxPremiere.Fund have been in the Finance Arena since 2010 and has been a working heavily with the Managed fund Company in Dubai, DIFC as an Exclusive Partner. Hes knowledge of dealing with high networth clients who are investing in Dubai Real Estate since 2010 has made a great path for his clients to also diversify and also invest in Managed Fund Firm in Dubai, DIFC.

A WIN WIN for all!

And now, we want YOU to join this exclusive

group of Investment Fund Management Portfolio!

FxPremiere's VIP Investment Fund

Dubai - DIFC Regulated

This strategy follows a long/short blue-chip multi-strategy, incorporating short-

term and long-term duration trades. The asset allocation is structured as follows: 80% US, 10% EU, and 10% Rest of the World. The investment

breakdown includes 75% equity, 15% commodity, and 10% fixed income.

“Fully Regulated in U.A.E. Dubai ”

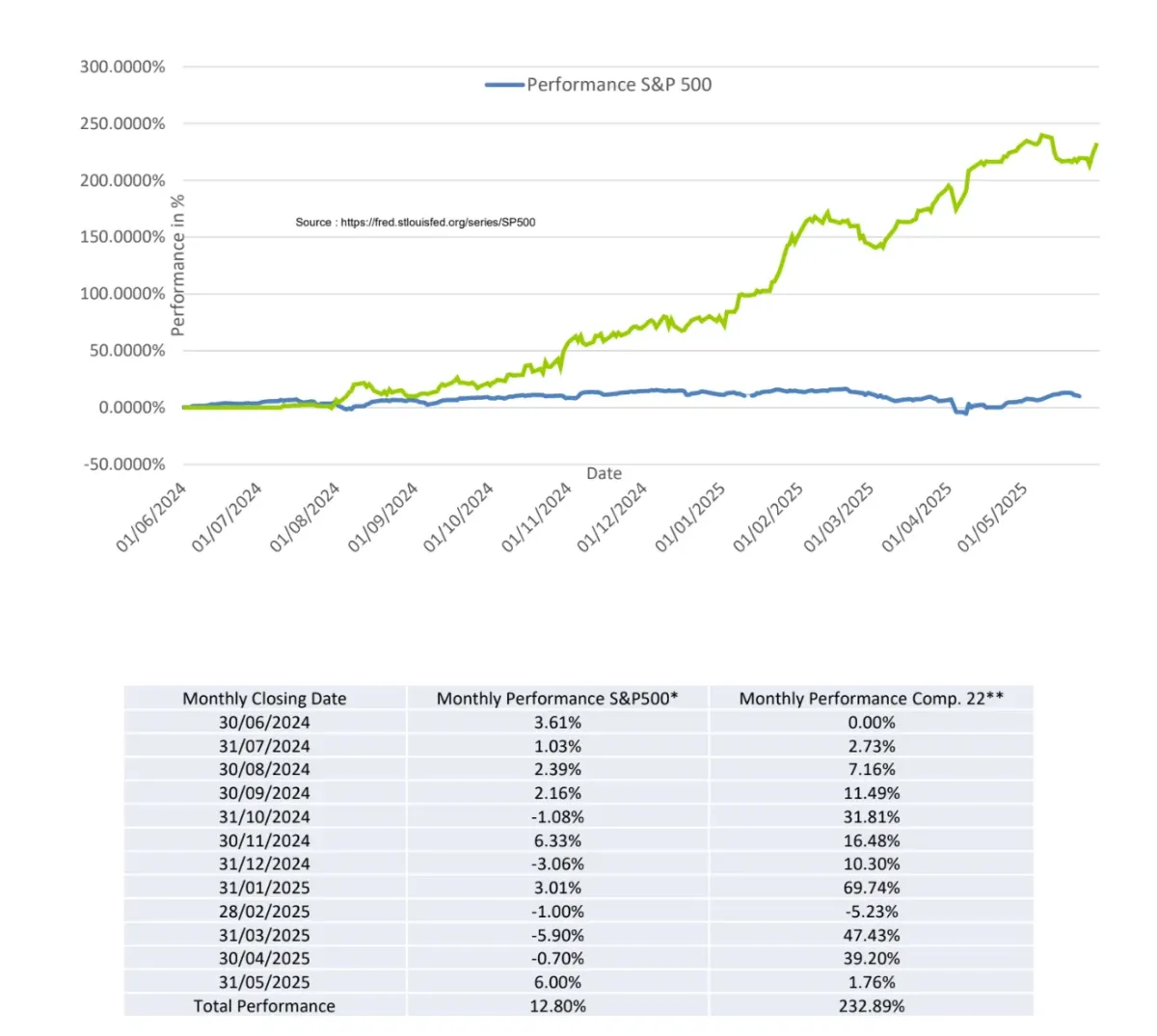

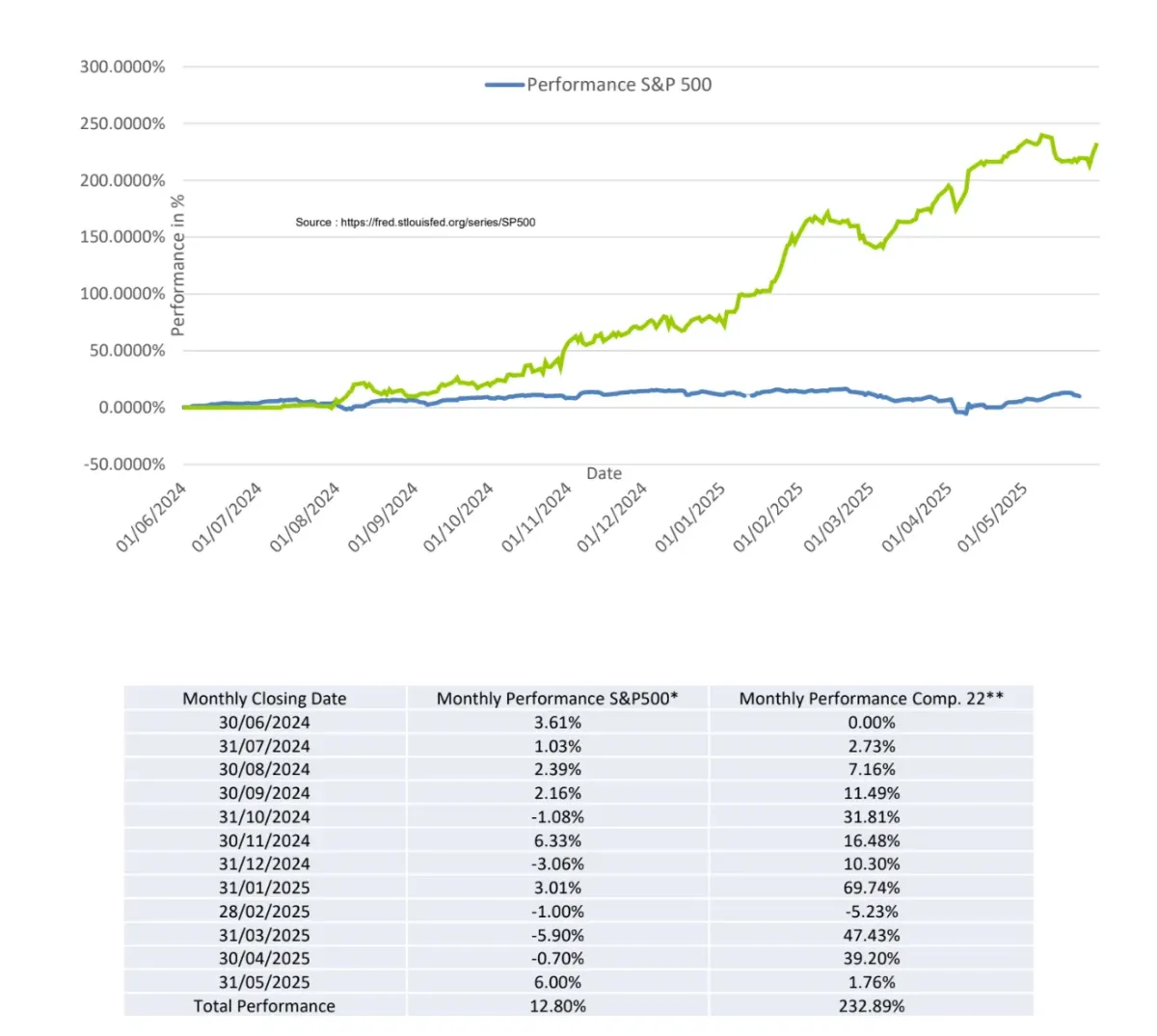

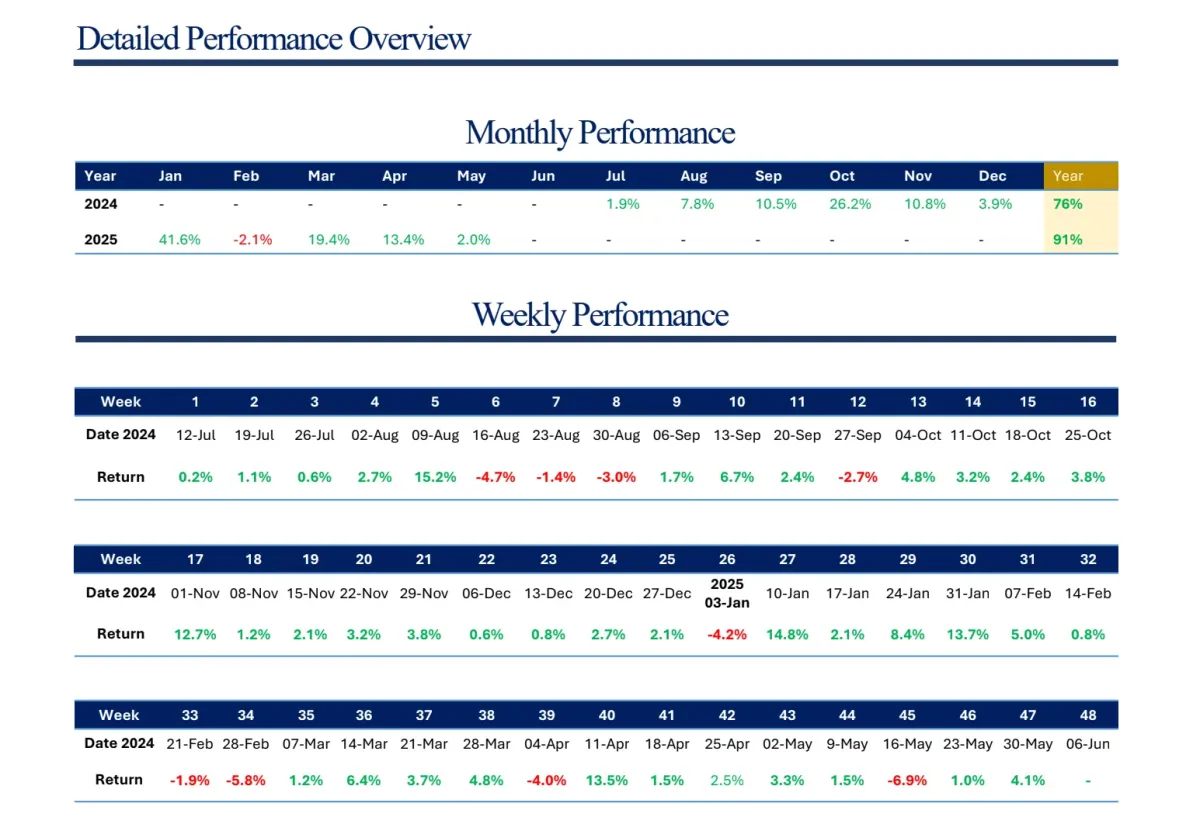

The primary investment objective is to achieve consistent alpha generation while outperforming the S&P 500 benchmark, regardless of macroeconomic fluctuations.

It will use a combination of fundamental analysis, profitability theory, and industry-changing events as catalysts.

Even If You’re Not 100% Confident get on a Call with us Now…

Paying Agent

FxPremiere a trusted global leader in Forex and Gold trading signals since 2010, is proud to announce its exclusive

Fully Managed Investment Plan via our OFFICIAL PARTNERS

—now available for qualifying high-net-worth clients through partnerships under strict UAE DIFC oversight

.

This elite offering is designed for sophisticated investors seeking secure, regulated, and professionally managed exposure to the markets , with minimum capital starting at $200,000 USD

.

Headquartered in Zurich, Switzerland, is a privately-owned specialized investment boutique with origins dating back to 1993.ISP services corporate clients, banks, and financial institutions worldwide.

The company is licensed and regulated by: FINMA (Switzerland) SFC (Hong Kong) SMV (Panama) DFSA (Dubai)

We Equip You with the Tools to Succeed

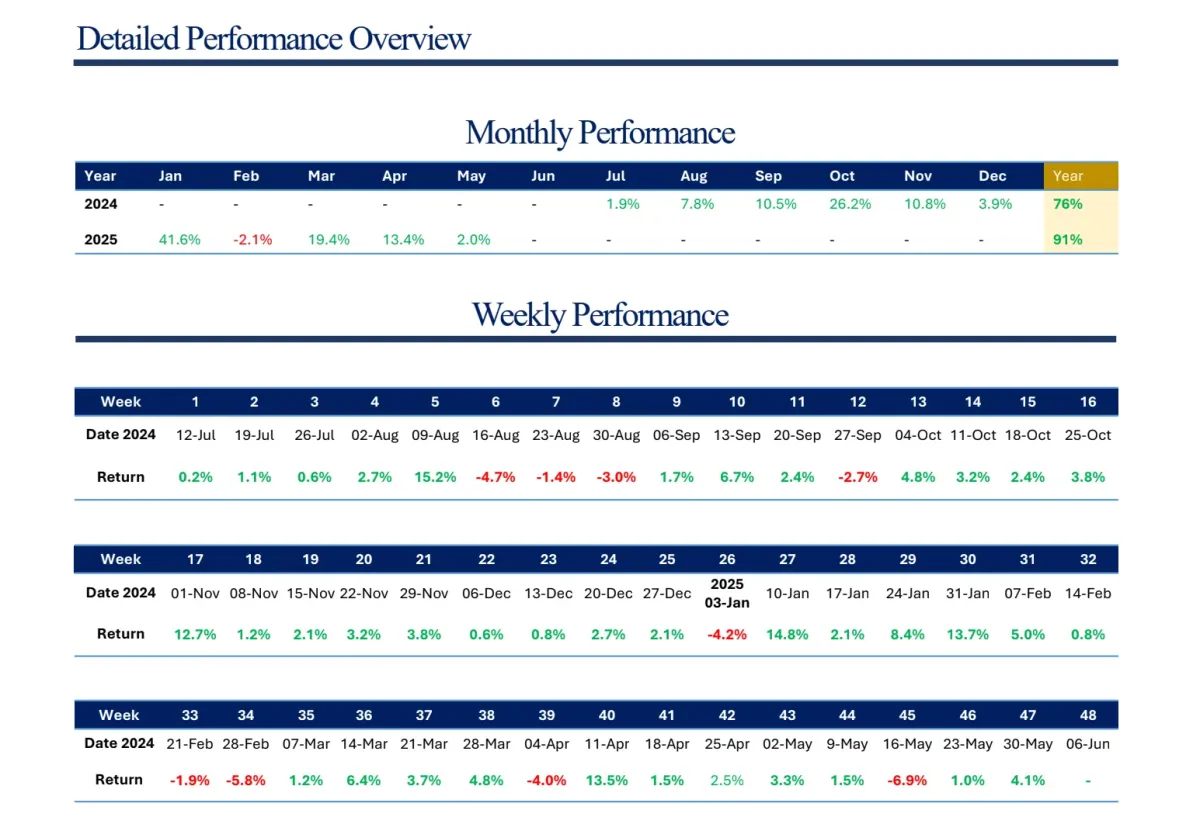

233% return for $9 MM AUM vs 6%

return of S&P 500 since inception on the 7th of July 2024

Asset Management Certificate (AMC)

✓ The AMC outperformed gold by

194% & bitcoin by 154%

✓ The AMC outperformed the S&P

Index across 80% of weeks

✓ The AMC max drawdown was 11%

vs 19% for the S&P

STEP 1

Personalized 1-on-1 Coaching Call

Hop on a private Call session with a certified and experienced Investment Fund Managers who explain to you the 200k Investment Strategy with weekly Trading Updates!

STEP 2

Platform Walkthrough

Dive deep into the Platform with Daily or Weekly updates on the Investment Fund Managers Trades updates. You will have access to see your Profit on email sent to you weekly.

STEP 3

✅ Offering Summary

Type: Fully Managed Investment Account – HIGH RETURN STRATEGY THE LIQUID EDGE MULTI STRATEGY FRAMEWORK

• Self-reinforcing portfolio with embedded hedging across four strategy vectors • nimble, opportunistic, and monetization of volatility to manage risk dynamically

• long-term strategies are high-confidence, asymmetric, and harvests structural alpha • diversified returns across macro & volatility regimes, reduce dependency on directional beta

STEP 4

Regulatory Oversight

UAE DIFC (Dubai International Financial Centre)

Fully compliant with international financial standards

Minimum Investment Capital: $200,000 USD

FxPremiere VIP Investment Offering

Is a Fast-Track to Real Money Management

Strategy: Diversified trading powered by our partners LICENCED firm proprietary

strategy suite

Risk Management: Advanced drawdown protection, equity stop-losses, and liquidity control protocols

Transparency: 24/7 investor dashboard access with live P&L tracking and monthly audited reports

Custodian Accounts: All client funds held securely with Tier-1 Banking institutions in segregated accounts

🌍 Who This Is For

This program is tailored for serious investors who want passive, yet high-performance exposure to the currency markets through a regulated, institutional-grade trading structure. Ideal for:

International business owners

Family offices

Dubai Golden Visa seekers

Wealth managers diversifying into Trading

Crypto traders reallocating funds into regulated markets

💼 Partnership Application & Onboarding

Steps to Get Started:

Fill out our private client interest form below for our Partners!

KYC & Regulatory Review: All clients undergo UAE DIFC-compliant onboarding

Capital Allocation: Minimum $200K wired to client-segregated brokerage account

Portfolio Deployment: Strategy begins within 72 hours of funding

Weekly Reports & Performance Access: Via secure client portal

📊 Performance Benchmarks

2023-2025 YTD Net ROI (Strategy-Weighted Average): +30.4-500+%

Risk Control: Max drawdown levels shown by partners

📞 Request a Confidential Consultation

Start your managed investment journey today with a trusted name in Investment intelligence. This is your chance to gain direct exposure to professionally traded markets—all with zero day-to-day involvement

.

PLEASE NOTE: ONLY CONTACT US WITH MINIMUM 200k USD INVESTMENT INTEREST

📲 Telegram Chat with us:

This is your moment to stop “trying” and start winning.

Take this once-in-a-lifetime opportunity.

🔐 Why Choose FxPremiere Partner Managed Plans?

W’ere Not Exaggerating.

Proven Success: Years of delivering precise, real-time globally

Regulated Partnership Model: Operated in collaboration with fully licensed asset managers under DIFC rules

Confidential Onboarding: All clients are vetted under strict KYC/AML protocols and are supported by private client advisors

Zero Setup Fees: No upfront fees. Profit-sharing models available with performance-based returns

Capital Security First: We never commingle funds; all investments are protected under regulatory account protections

©️ FxPremiere.com | All Rights Reserved

FxPremiere.Fund is a Separate Entity to FxPremiere.com - FxPremiere.Fund is a Affiliate Partner to Regulated Managed Fund Firms ONLY!